RBI to Launch Unified Lending Interface to Transform Lending Space, Medi Assist Insurance to Acquire Paramount Health, Canada to Impose 100% Tariff on Chinese EVs, Russia Unleashes Massive Attack...

Daily Equity Dashboard

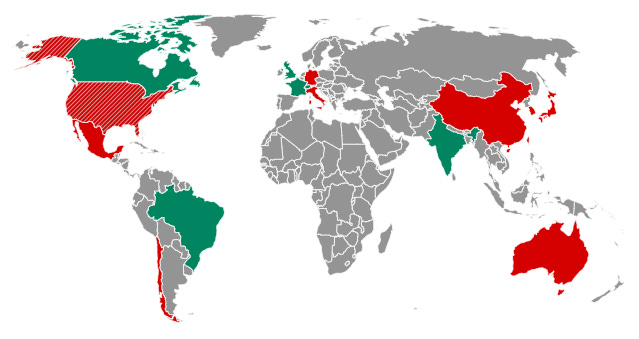

World Stock Market Indices Heat Map as on 27/08/24 at 08:10 am. (Source: CNN)

Today's Top Headlines You Can't Miss

RBI to launch Unified Lending Interface to transform lending space: Das.

Financial regulators back ISA 600 for auditors of listed companies.

Fiscal deficit to increase by 15 bps to 5.1% in FY25 due to UPS.

Resourceful Automobile IPO Subscribed More Than 400 Times On Day 3.

Bajaj Finserv, Bajaj Finance shares gain ahead of mortgage arm IPO.

Medi Assist Insurance TPA to acquire Paramount Health for Rs 312 crore.

Bank of Baroda raises Rs 5,000 crore via 10-year infra bonds at 7.3%.

Russia unleashes massive drone, missile attack on Ukraine, at least 5 dead.

Top Local News

Markets rise as Fed chief Jerome Powell's comments fuel global rally.

Rupee gives up early gains to end flat due to importers' dollar demand.

Paytm seeks Sebi settlement over potential ESOP issuance norms violation.

Vedanta sets Rs 30,000 cr war chest to pursue further deleveraging, growth.

GDP growth rate likely to decline to 7.1% in Q1, say SBI economists.

GST payers with no valid bank account barred from filing GSTR-1 from Sept 1.

UltraTech Cement raises $500 mn through sustainability-linked loans.

Bhel wins thermal projects worth Rs 11,000 crore from Adani Power.

HCLTech extends partnership with Xerox in AI and digital engineering.

ICICI Bank invites bids to sell $28 million exposure in John Energy.

Kalyan Jewellers’ Promoters to Raise ₹2,500-cr Debt to Boost Equity Stake.

Mutual funds take to factor-based investing; bridging active, passive gap.

Deepak Shenoy's Capitalmind gets in-principle approval for MF foray.

Tata Group to give jobs to 4,000 women from U'khand at TN, Karnataka plants.

Interarch Building Products' shares surge nearly 34% in market debut.

Patel Retail, Garuda Construction Get Sebi's Nod to Float IPOs.

UPS: Central staffers may get to keep higher returns from riskier bets.

These 3 penny stocks would have made you a millionaire in 20 years.

Any correction in oil marketing companies could be a buying opportunity.

Amazon Pay UPI surpasses 100 million customers, marking a major milestone.

Bajaj Auto targets 100K monthly sales of clean energy vehicles: Rajiv Bajaj.

Adani group's Ebitda may go past Rs 1 trn in FY25 on infra, power biz.

Nasscom announces SAP Labs India MD Sindhu Gangadharan as chairperson.

PhonePe turns profitable with adjusted PAT, revenue up 74% for FY24.

Railways union welcomes Unified Pension Scheme, seeks 8th Pay Commission.

87% of Indians believe increased financial uncertainty in 5 years: Report.

Top International News

Nvidia sales likely doubled - even that may not impress investors.

Middle-east on edge after Israel's bombing of Lebanon to thwart attack.

Dutch watchdog fines Uber $324 mn allegedly for not protecting driver data.

President elections put Nippon Steel's $15 bn takeover of US Steel in peril.

More than 70 dead after multiple militant attacks in Pakistan's Balochistan.

Alleged child protection failures on app led to Telegram CEO's detention.

What to watch out for…

AGM: IndusInd Bank, Maruti Suzuki India, PI Industries, Uno Minda, UPL.

US: FHFA House Price Index, Richmond Fed Manufacturing Index.

UK: BRC Shop Price Index.

China: Industrial Profits.

News related to Israel–Hamas conflict, Ukraine-Russia War, Inflation and Rate Cuts.

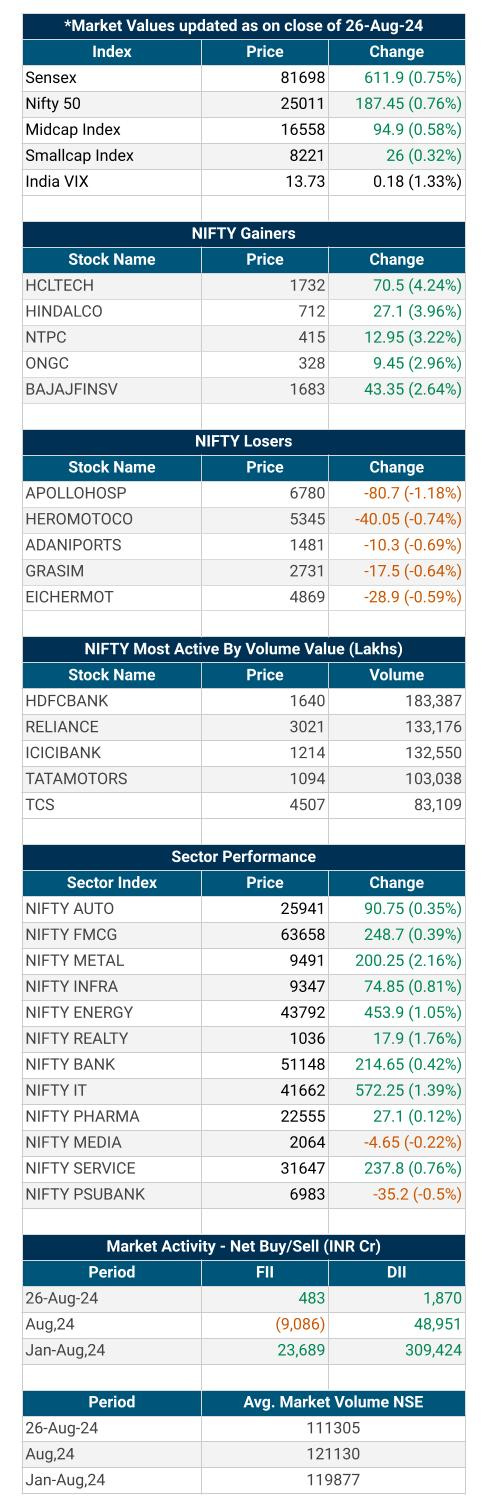

Key Highlights from Last Trading Session

Indian indices ended in strong note on August 26 with Nifty back above 25,000 and also inched closer to its record high, after Fed Chair Powell at its latest meeting hinted interest rate cuts in the near future. At close, the Sensex was up 611.90 points or 0.75 percent at 81,698.11, and the Nifty was up 187.45 points or 0.76 percent at 25,010.60.

The BSE midcap index was up 0.6 percent and smallcap index was up 0.2 percent.

Except PSU Bank (down 0.5 percent), all other sectoral indices ended in the green with Information Technology, Metal, Oil & Gas, Realty up 1-2 percent.

Market Data

Sources:- Moneycontrol, Economic Times, Times of India, CNBC, CNN, Business Standard and AMFI.