Sebi Proposes Mandatory UPI Block Secondary Market & Overhaul of Investment Banking Norms, RIL & Disney's Merger Gets CCI Nod, Buffett's Berkshire Hathaway 1st US Non-Tech Co to Top $1 Tn Mcap...

Daily Equity Dashboard

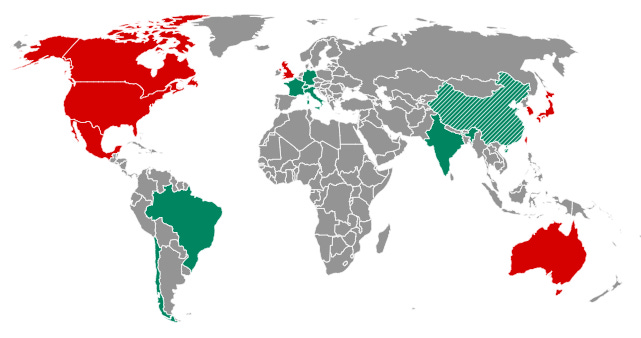

World Stock Market Indices Heat Map as on 29/08/24 at 08:40 am. (Source: CNN)

Today's Top Headlines You Can't Miss

Sebi proposes mandatory UPI block secondary market for larger brokers.

Sebi proposes overhaul of investment banking norms amid boom in ECM.

RIL-Disney India merger worth $8.5 billion receives approval from CCI.

Warren Buffett's Berkshire Hathaway 1st US non-tech co to top $1tn mcap.

Union Cabinet approves 12 industrial smart cities worth Rs 28,602 cr.

India likely to plan raising vegetable oils import taxes, govt sources say.

MFs, AIFs to gain higher weight in family office portfolios: Report.

Nifty records fresh high after longest winning streak in four years.

Sebi seeks RBI support to boost participation in corporate bond repo market.

IndiaFirst Life becomes 1st Indian life insurer to start ops in GIFT City.

Top Local News

Orient Tech shares hit 5% upper circuit on BSE; up 48% from IPO price.

Small, MidCap indices outperform Sensex for 5th straight month in FY25.

BharatPe launches UPI offering, taps into consumer payments segment.

Private equity player GQG Partners hikes stake in GMR Airports to 5.17%.

HC orders Sebi, NSE, BSE to pay Rs 80 lakh for illegal demat a/c freezing.

RBI focusing on making UPI, RuPay truly global, says Governor Das.

Co-founder Rakesh Gangwal to further pare down his stake in IndiGo.

Bernstein initiates coverage on retail and restaurant stocks.

SBI raises Rs 7,500 cr via tier 2 bonds to meet regulatory needs, others.

Zomato completes acquisition of Paytm's entertainment ticketing biz.

Indus Towers to become Bharti Airtel subsidiary after share buyback.

Paytm Payments gets govt nod; can now resubmit its PA application.

Oyo reports Rs 132 cr in Q1 profits, aims for Rs 700 cr in full year FY25.

UPI transactions can touch 100 bn in next 10-15 years: Dilip Asbe.

'Finternet' the future of financing systems, says Nandan Nilekani.

Delhi HC overturns AAR ruling on Tiger Global-Flipkart transaction.

Satish Vadugiri named interim chairmen for IOC, Rajneesh Narang for HPCL.

Jio's network cost per tower less than Airtel's but gap shrinking: Analysts.

MUFG Bank expects over 25% growth in India biz; to focus on large cos.

Will strive to make SBI most valued financial institution: Chairman Setty.

Single bid for national highway projects will be acceptable: Morth.

PM Modi chairs PRAGATI meet, reviews projects worth more than Rs 76,500 cr.

Digital transactions in India to grow threefold by 2028-29: Report.

Top International News

Apple cuts 100 jobs in digital services group as priorities shift.

Hyundai targets 30% rise in sales by 2030, as it doubles hybrid lineups.

Israeli raids in occupied West Bank have killed 9: Palestinian officials.

China proposes new curbs on grain imports in order to boost local prices.

China's two richest people lose billions in record-breaking stock selloffs.

Protests on rise in China amid sluggish economy, housing crisis: Report.

X suffers brief outage, thousands of users report interruptions.

African debt crisis may have severe implications for world economy.

What to watch out for…

AGM: Reliance Industries, Aurobindo Pharma, Avenue Supermarts, ICICI Bank, Indian Railway Finance Corporation, Indus Towers, Jubilant FoodWorks, NTPC, Samvardhana Motherson International.

US: GDP, GDP Price Index, Jobless Claims.

News related to Israel–Hamas conflict, Ukraine-Russia War, Inflation and Rate Cuts.

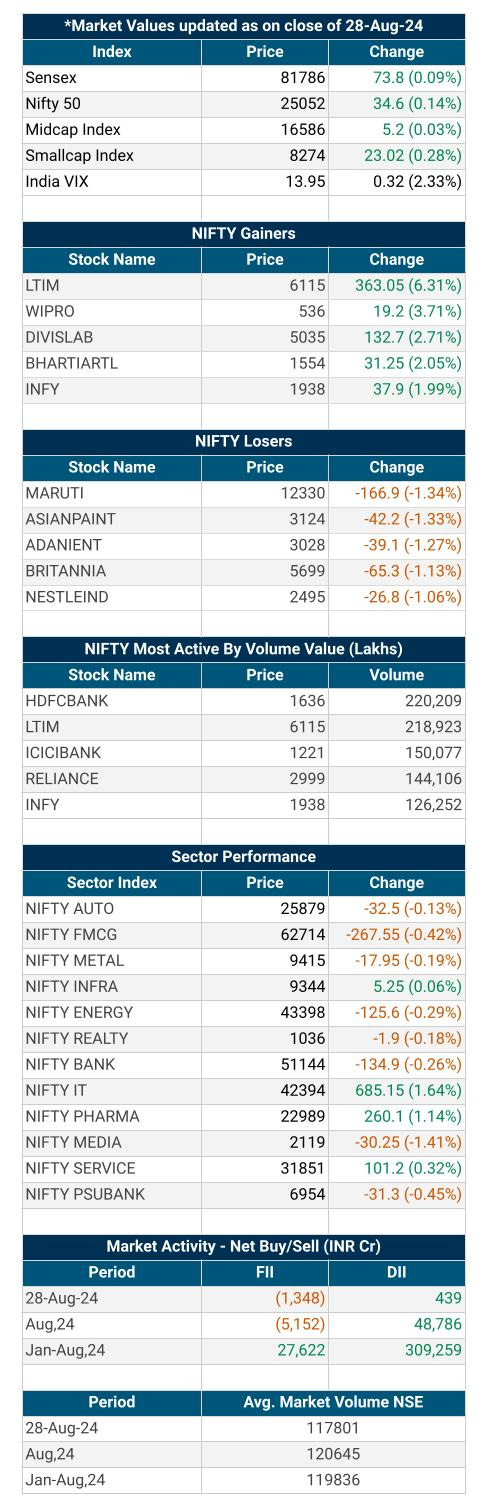

Key Highlights from Last Trading Session

Indian indices ended higher on August 28 with Nifty crossing its previous record high (25,078.30) and surpassed 25,100 for the first time led by Information Technology and pharma stocks they saw profit booking by end of the session. At close, the Sensex was up 73.80 points or 0.09 percent at 81,785.56, and the Nifty was up 34.50 points or 0.14 percent at 25,052.30.

Among the broader markets, the midcap as well as smallcap indices outperformed the benchmarks and rose around 0.5 percent each.

Among sectors, FMCG was the worst hit as it slipped over 1 percent, followed by energy, automobiles and metals, which were down 0.1-0.6 percent. On the other hand, banks, pharma and realty indices rose 0.2-0.8 percent.

Market Data

Sources:- Moneycontrol, Economic Times, Times of India, CNBC, CNN, Business Standard and AMFI.

Share